No, Universal Basic Income Does Not Require Tax Rates of 40 to 60 Percent

Lots of news articles are being written about a new study in Ireland of UBI, and as usual, the discussion is misinforming, as is the study itself. I responded with a long thread on Twitter. Here's that thread in blog form and slightly expanded upon.

Today we published our study on Universal Basic Income, with @ESRIDublin colleagues @seamusmcguinnes and Klavs Ciprikis

— Paul Redmond (@PaulRedmond9) December 20, 2022

Available here: https://t.co/sGdvYNI89k

UBI is a popular idea, but despite the mainstream interest in it, little is known about it... (1/8)

First, let's start with the headlines. I'm seeing many choose to focus on the proposed tax rates of 40% to 60%. I haven't seen a single article talk about effective tax rates, the difference, or UBI as a tax rebate. This is basically lying by omission. When people hear that UBI will require 60% tax rates, a fair assumption to make is that their after-tax income will be reduced by 60%. Bad assumption.

Let's say your income is $50,000. If you paid a 100% tax and got a $50,000 UBI, what would your effective tax rate be? 100% or 0%? The answer is zero in terms of effective tax rate despite having a 100% marginal tax rate. After taxes you'd have exactly the same amount of money as before taxes. That seems kind of important to understand, right?

Also important is the amount of UBI. A small UBI can require a small increase in taxes to maintain fiscal neutrality, especially if spending is reduced elsewhere either with purposeful replacement by UBI, or indirectly due to UBI reducing the demand for that spending, like for example reduced hospitalization rates.

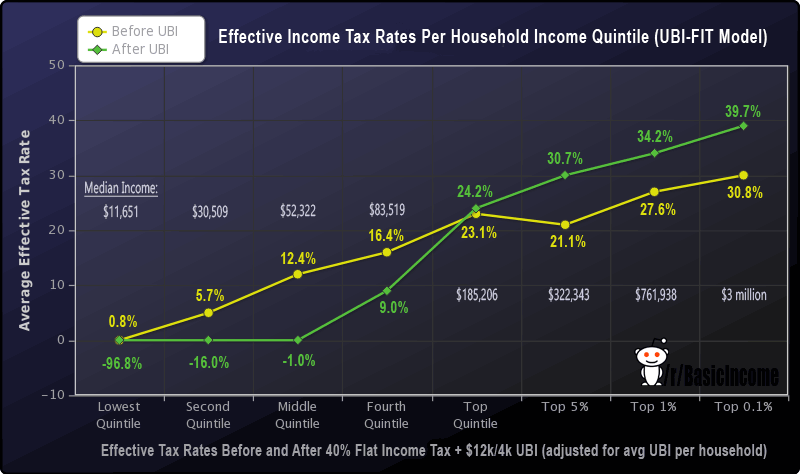

Now take the 40% headline number. I've looked at this rate before in my own estimates. Here's what the effective tax rate looks like by decile. Notice how much lower the effective tax rate is for most people. The bottom half would have a NEGATIVE tax rate.

A 40% tax rate paired with a flat rebate doesn't actually equate to a 40% tax. It only nears that rate at the very top of the income spectrum. If 40% means $20k in tax and the UBI rebate is $15k, then tax owed after the tax rebate is actually $5k, not $20k, and thus 5%, not 40%.

So where are the headlines about a 5% tax rate? Why is no one talking about how it's possible for most people's increase in taxes to be far less than the UBI they get, leaving them with more money from one perspective, or less taxes from another perspective?

It's not that it's false to say that income tax rates could go from 20% to 40%. They could. But that provides people a false impression of the net impact on their incomes if it's not explained within the context of the UBI as a negative tax and resultant effective tax rates vs marginal tax rates. There's also other ways of taxing than income taxes, like for example consumption taxes, carbon taxes, transaction taxes, corporate taxes, wealth taxes, and land value taxes. Using any of these alternatives or combination of them would reduce the need to raise income taxes.

The fact is that UBI will always be a policy that is a combination of money and taxes and it makes no sense to focus on only one or the other outside of proposals that involve zero taxation, which virtually no one is suggesting. This also impacts cost.

The cost of UBI is never what most headlines and articles suggest it is, because most only look at the gross cost and ignore the net cost. If the government sends you $100 and taxes you $50, that's the same cost as just sending you $50 and taxing you nothing. Either way you end up with $50 more from the government.

Another way of looking at this too is also considering a phased-out version meant to exclude the rich, which most people would consider to be cheaper. But that's wrong. It's not cheaper. It's just using a budget gimmick to make it look cheaper by not counting phaseouts as taxes.

But all phaseouts are taxes. In the aforementioned example it would be the same as providing $50 after a $50 phaseout tax, making it again cost $50, just like giving $100 and taxing $50. However, and this is really important, they are not administratively identical. One does cost less.

Means-testing isn't free. It costs money. Phaseouts also apply higher than necessary marginal tax rates on those in the phaseout range. Matt Bruenig has been hammering this point recently more than anyone, and he's absolutely right. Most everyone else is wrong.

For any policy design comparing an income-tested approach to a universal approach with the same net outcome, the universal approach is cheaper. Using a surtax instead of a phaseout means less administration. It can just use the existing tax process to accomplish the same intended phaseout outcome.

A universal plus surtax approach also creates the ability to spread the tax out, lowering the marginal tax rate and thus the impact on labor supply, meaning that a universal approach is also cheaper because fewer people are discouraged from employment.

For example, consider a $3k universal basic income for kids. Bruenig zooms in on a potential phaseout of 5% starting at incomes of $200k for single adults and $400k for married couples. This same phaseout could be achieved at a lower admin cost with a 5% surtax on families with kids who have incomes in the phaseout range. Or it could be achieved by a 2.2% surtax on all families with incomes in the phaseout range. Or it could be achieved by a 0.6% surtax on everyone with incomes above the original phaseout point instead of only in the phaseout range.

A 0.6% marginal tax rate hike on high earners should be recognized as obviously superior to a 5% marginal tax rate hike on specific households with kids in a specific income range that excludes the richest and the childless from a tiny tax hike that would negate the need for a huge clunky bureaucracy of means-testing.

The above link uses a universal child allowance to explain the point. Because it would only go to parents, a tax on both parents and non-parents can be recognized as cheaper than just taxing parents. However when it comes to UBI, other taxes can also be cheaper than phaseouts.

Because UBI goes to everyone and also taxes everyone, it's also possible to shape the phaseout through additional taxes far more progressively than via phaseouts. Can you imagine how complicated a progressive phaseout versus a flat phaseout is to administer? It would look like what New York wants to do with their disastrously designed "Working Families Tax Credit."

UBI however can use any combo, type, and amounts of taxes it wants to achieve the desired outcome, and the results would be far better too because the calculations are all made after taxes are reported instead of estimated beforehand. This means no need for adjustments after taxes. That saves time and resources.

Because UBI doesn't apply tests, it also means that more people with the lowest incomes actually successfully receive cash who wouldn't have received cash with a test in place, despite being the intended recipients of the program. This is also why headlines that claim that the poor could be worse off can be wrong too. It ignores how many people fall right through the safety net. If an existing program doesn't reach 75% of its intended low-income recipients, and the other 25% end up with slightly less income as a result of a UBI design, is it being honest to ignore the 75% who start getting UBI instead of nothing? That seems important to recognize too.

I think what I've covered here is one of the main bottlenecks to achieving UBI, if not the main one. As long as policymakers look at phaseouts as less money spent instead of a different and worse tax, universality will continue being seen as prohibitively expensive, and we'll see headlines about scary tax rates.

Not seeing phaseouts as taxes is what makes UBI seem more expensive than it is. It makes it that much harder to understand the true cost, and that much easier to write uninformed articles and misinforming headlines about high tax rates needed for UBI.

Focus on the outcome of a UBI as tax rebate/prebate paired with taxes. That's what matters. What is the net result? How much more or less money do people have? Who does it boost and no longer miss compared to the status quo? What are the labor responses and tax responses? How does behavior change? What's the after-tax change on income and wealth distribution? These are the questions to ask.

We are not going to achieve UBI as quickly as we need to (which was decades ago but immediately is now second best) so long as the UBI conversation is so misinformed. Hardly anyone reading the garbage out there will also read posts like this. It's an uphill battle for sure.

If you want to help UBI happen, please help in amplifying content like this that I and others create to better inform this extremely important conversation. I just wish social media cared more about nuance and less about "OMG, 60% tax rates!"

Thank you to all who subscribe to and share posts like this. I appreciate you.

Do you want more content like this? Please click the subscribe button and also consider making a monthly pledge on Patreon in support of my UBI advocacy.

Special thanks to my monthly patrons: Gisele Huff, Haroon Mokhtarzada, Steven Grimm, Katie Moussouris, Tricia Garrett, Zack Sargent, Larry Cohen, Matthew Cheney, Frederick Weber, CanadayVibes, Kerry Bosworth, Laurel Gillespie, Dylan J Hirsch-Shell, Tom Cooper, Michael Tinker, Robert Collins, Daryl Smith, Joanna Zarach, Justin Walsh, ace bailey, Daragh Ward, Albert Wenger, Andrew Yang, Bridget I Flynn, Peter T Knight, David Ihnen, Myles McLane, Max Henrion, Elizabeth Corker, Gray Scott, Gerald Huff, Albert Daniel Brockman, Michael Honey, Natalie Foster, Joe Ballou, Chris Rauchle, Arjun, Chris Heinz, Juro Antal, Herb, Justin Seifert, Jodi Sarda, Sharon Woodhouse, Rosa Tran, Deanna McHugh, miki, Adam Parsons, bradzone, Lee Lor, Akber Khan, John Sullivan, Team TJ, Yang Deng, Elliot Lee, Yan Xie, Marie janicke, Iggy C, engageSimply - Judy Shapiro, AYFAQ.com, Phuong Truong, Tim, Warren J Polk, Timothy P O'Connor, Jeffrey Emmett, Stephen Castro-Starkey, Oliver Bestwalter, Kev Roberts, Walter Schaerer, Loren Sickles, anti666, Eric Skiff, Thomas Welsh, Kai Wong, Laura Ashby, and all my other monthly patrons for their support.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.