Payday Loan Lenders Are Unstoppable… Or Are They?

The Effects of a Basic Income on Loans and Debt

As many may have recently learned from John Oliver in his segment on predatory lending, there appears to be no stopping the viral Whac-A-Mole nature of payday loan lenders. For those who missed this infuriatingly informative yet still hilarious segment, here it is:

Payday loans are a massive $9 billion tick feeding on our own human misery. With their legs wrapped around our bought and paid for legislators, and their mouths embedded deep within what is left of our wallets, they continue to suck away our increasingly shrinking incomes (we are earning almost $6,000 less than we were in 2007 adjusted for inflation) despite all attempts to prevent their business model.

Why is this? Because of demand. We need money and we’re all out of options. Our first strategy was having two incomes per household instead of one. Our second strategy was finding another job and/or working longer hours. Our third strategy was leaning on credit cards. Our fourth strategy was leaning on our mortgages. There’s nothing left on which to lean to pay our bills. For those with bank accounts, we make use of overdrafting. For those without bank accounts, we make use of payday loans. Both involve extremely high interest rates.

Instead of such reliance on high interest loans and debt, what if we just credited ourselves enough income to avoid the demand for high interest loans and debt in the first place?

This idea may sound crazy at first, but it’s the basis for the establishment of an unconditional basic income, where every citizen would get a base level of income to cover basic needs (around $12,000 for adults and $4,000 for minors potentially based on 2014 Federal Poverty Guidelines), with no work requirement.

I’ve written about this idea before, but for those who are new to it, or who just plain hate the idea of payday loans and cash advances, you may be interested to discover the observed effects of basic income on debt and loans in basic income guarantee (BIG) experiments and programs in Namibia, India, Uganda and Kenya.

Namibia

Some of the best evidence we have for what actually happens when people are outright given a year’s worth of basic income can be found in the experiment in Otjivero-Omitara.

The BIG contributed to the reduction of household debt with the average debt falling from N$ 1,215 to N$ 772 between November 2007 and November 2008. Six months after the BIG was introduced, 21% of the respondents reported saving some of the money. Savings were also reflected in the increasing ownership of large livestock, small livestock and poultry. -Source

More than twice as many people who received a basic income in Namibia reduced their debts than increased it, and those who decreased their debts cut them almost in half. Meanwhile, savings rates also went up, with more people being able to rely on their own surpluses instead of those of others.

From the BIG Pilot Project Assessment Report:

In June 2008, 41% of the respondents reported to be using the BIG to help pay back debt, but only 9.4% of total BIG payments were allocated to that purpose. This suggests that a large number of people are paying back debt, but that the amounts are small. This is consistent with the picture provided by total household expenditure during the first six months which saw an increase in the average monthly debt repayment from N$ 186 to N$ 200. Some households paid off their debts altogether – whereas others increased their debts.

It should be stressed that the BIG results in Namibia were found to be so impressive, with numerous other notable effects like reduced crime rates and increased health, that the completed project has recently been resumed for another year thanks to a church in Italy.

India

Unicef funded an experiment that took place in 20 villages in Madhya Pradesh. It randomly assigned 8 villages where everyone received a basic income. Meanwhile, 12 similar villages were used as a control group where no one got a basic income. Again the effects were impressive across the board, but let’s again draw focus to the effects on debt.

Cash grants were associated with a significant reduction in indebtedness, both because recipients used the money to reduce existing debt and because they were able to avoid taking further debt. Those receiving cash grants were more than twice as likely to reduce debt as those not receiving cash grants. Cash grants also led to a significant increase in savings, even in households with debt. Households often used the money to acquire financial liquidity. Opening bank accounts for remitting the cash grants became in itself an important measure of financial inclusion. -Source

Again, people were twice as likely to reduce their debts as they were to increase them, while savings also increased — the same result as found in Namibia. Because of this, there was only one group to complain.

“The only group to complain about the [basic income] pilots were moneylenders.”

Uganda and Kenya

The pioneering charity GiveDirectly is also making some very interesting observations of what happens when money is given unconditionally to those in need, in amounts about equivalent to basic incomes. One might think people would work less with unconditional incomes, or use them unwisely, but instead people become entrepreneurs, increasing their incomes above what they are given, and increasing their overall hours worked. Assets are increased. Businesses are started. Mental health is improved. Diets are improved. Cortisol (stress) levels fall. The one thing that doesn’t seem to change — money spent on alcohol and gambling.

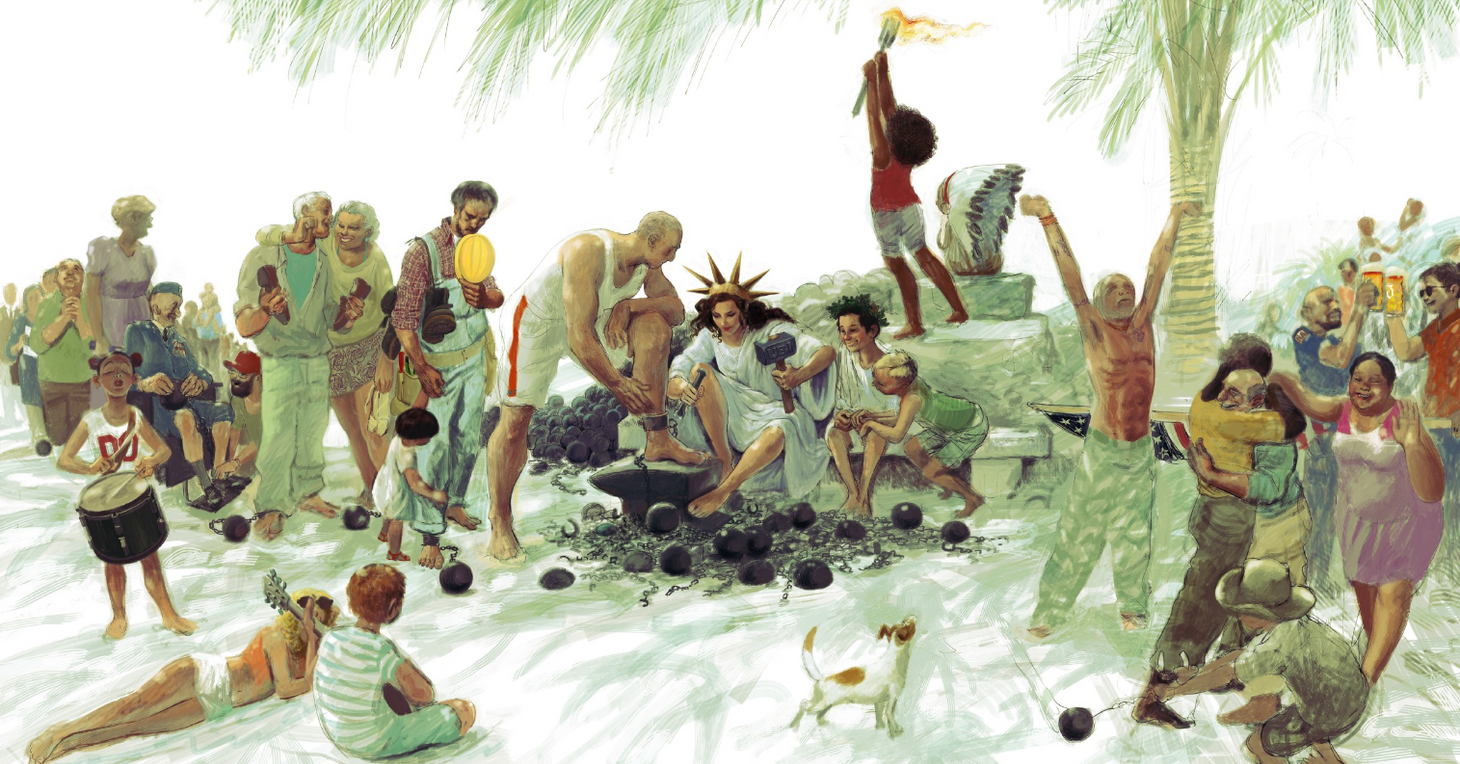

What we need to come to relearn as a society, is that usury hurts all of us. Loaning people money at high rates of interest feeds into a system built upon human misery. We’re looking at the world and everyone around us all wrong, believing people need first prove to those with money that they are worthy of money, and owing a pound of flesh in return for the privilege, instead of believing people need not first prove anything, and are inherently worthy of money, owing nothing in return but showing returns on investment anyway.

Where money is given without conditions, where we orient ourselves more around social credit, instead of social debt, we observe humanity at its best. If we are to cleanse our temples, as in the biblical tale, we need to flip the table too. And flipping that table will involve establishing an unconditional basic income, paid to every citizen. Then the idea of payday loans can become a part of ancient history, replaced instead with human dignity and mutual prosperity.

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.