How Work Requirements are Actually Anti-Work and Why the Fully-Refundable Child Tax Credit is Pro-Work

The fully-refundable CTC is a better way. It needs to stay.

Won’t people stop working if they receive income independent of work?

That’s always one of the first questions asked in regards to any government benefit that doesn’t require employment or job-seeking in order to receive it.

The assumption that the answer to that question would be yes for most people is what led to the welfare reforms under President Bill Clinton that were centered around work requirements. Such assumptions have since been shown to be false, and even counterproductive.

To the contrary, the lack of a work requirement actually better enables and rewards work.

We can see evidence of this when President Clinton did his welfare reform in 1996, ending Aid to Families with Dependent Children (AFDC) and creating Temporary Assistance for Needy Families (TANF). As a result, the number of people on the welfare rolls went down, and the number of people in poverty went down too.

This appeared on its face to be a big win, but the reduction in poverty was mostly due to the booming economy, and the fact that fewer people received welfare ended up being due to people no longer successfully qualifying for welfare, not less need of assistance.

After the economic bubble burst in 2000, and burst again in 2008, welfare was no longer able to help people like it did prior to 1996. A safety net built on employment requires employment, and so during the Great Recession, when the number of unemployed people doubled, the number of TANF recipients only went up by a mere 13%, and that was a national average. In some states, right when more people needed help, the number of people on welfare actually decreased.

When jobs dry up, and with it people’s incomes, it becomes that much more difficult to create new jobs, because people lack the money to be customers. Spending power needs to be maintained to fuel jobs. Additionally, because employment-conditional benefits like TANF and unemployment insurance both disappear with employment, that’s a disincentive that essentially mandates that people either accept extremely low wages or extremely high taxes.

From the Perspective of Working Americans

If someone is receiving $7,000 a year in benefits, and they accept part-time employment that pays the federal minimum wage of $7.25 an hour such that they then earn $10,000 a year, the loss of the $7,000 would mean a real gain of only $3,000. If they work 20 hours a week, then they aren’t actually working for $7.25 an hour, but effectively instead $3 an hour.

Another way of looking at the loss of $7,000 in exchange for earning $10,000 is a $7,000 tax, which is a 70% tax rate. The current highest tax rate is 37%. So it’s not true to say that the rich pay the highest tax rates. It is in fact those receiving government assistance who accept employment to increase their incomes who end up paying the highest tax rates of all.

Put yourself in the position of being offered a job that pays $3 an hour, or paying a tax rate of 70% if you accept the job. Are you lazy if you decline to accept that job? No. Why would anyone accept either of those choices unless they felt they had no other choice? That’s why work requirements really exist, not because people are lazy, but because people are rational.

The beauty of the Child Tax Credit (CTC) is how it has transformed the above choices.

Because the Child Tax Credit isn’t lost when parents accept any amount of employment that pays less than $75,000 a year as a single parent, then job offers become more rational to accept. With the CTC, the real wage is the actual wage, and the real tax rate is the normal tax rate. This reduces the entirely rational reasons to decline employment, and this behavior is already being observed.

Humanity Forward recently partnered with a team of researchers from Washington University in St. Louis, Appalachian State University, University of North Carolina, Greensboro, and the Urban Institute to survey a nationally representative group of 1,514 American parents to look at the impact of the child tax credit on employment, and what was found is that the Child Tax Credit is indeed pro-work.

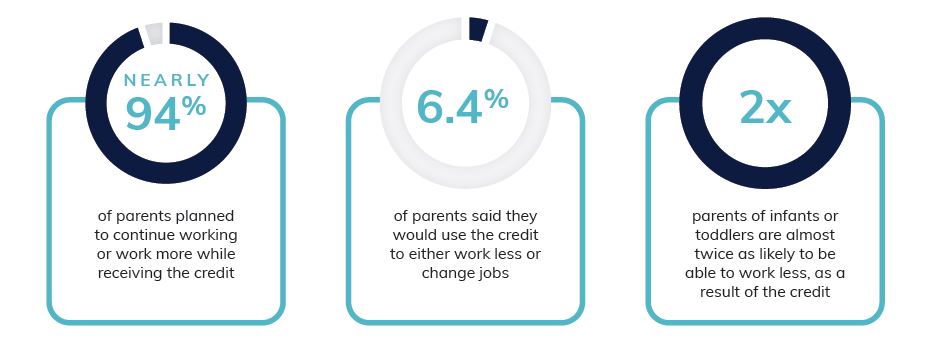

94% of parents said they intended to do just as much paid work or more, and the 6% who said they intended to do less work were mostly parents of newborns and those seeking to educate themselves, both of which are forms of unpaid work, and both of which are investments in the future.

Additionally, 21% of parents said they either owned a small business or intended to launch one soon, so the CTC doesn’t only not reduce the amount of work being done, but also assists in helping people create and support their own jobs. And that’s true on two fronts. Besides supporting entrepreneurs directly, it also boosts the spending power of parents, creating more customers, which indirectly further boosts small businesses and everyone they employ.

A report from the Niskanen Center estimates that the additional spending from the Child Tax Credit will support the creation of over half a million full-time equivalent jobs, and disproportionately boost small town rural economies across the country. This is what happens when you directly boost the income of the poorest 20% of families by an average of 37.4% as the CTC is doing. Consumers with money to spend are the true job creators.

It’s also vital to understand that there are costs associated with employment, especially for parents. If one parent in a two-parent household is offered a job, and that job pays less than the costs of the child care that would be required as a result, it does not make financial sense to take that job, because the household would see reduced overall income after expenses.

On the flip side, someone whose kids are in child care while they’re at their place of employment could decide to increase their household income and the happiness of their kids by doing that work at home themselves, which would also open up a position for someone unemployed without kids. There are also additional costs like transportation, clothing, prepared meals, and many more that go along with working outside the home. Working is not free. Bootstraps require boots.

The beauty of the Child Tax Credit is that it recognizes all of this and helps make employment make more sense while also simultaneously making care work at home make more sense too. By being agnostic to work, the CTC doesn’t punish people for choosing paid or unpaid work, and instead supports all forms of work. It provides parents the freedom of choice to self-determine what’s most important for their families.

Be it spending on basic needs like food and housing, or saving for emergencies, or growing a college fund, or investing in stocks or crypto for their kids’ futures, or covering school and after-school expenses, or paying for child care, or buying presents, or affording anything else otherwise unaffordable without it, the child tax credit is an investment in the future of America through the expansion of financial freedom.

Common Objections to the Child Tax Credit

To anyone who claims the Child Tax Credit is anti-work or too expensive, I urge you to acknowledge how truly anti-work it is to tie benefits to low-wage employment, and how expensive it is to turn down an investment with an 800% return. Would you refuse to pay $100 to buy $800?

I also urge everyone to look at the accumulated evidence from all over the world. A 2020 peer-reviewed meta-analysis of 38 studies of cash transfers that lacked a work requirement did not find any evidence of a significant reduction in employment. Instead, they found evidence that “labor supply increases globally among adults, men and women, young and old.”

The only decreases in employment they found were “children, the elderly, the sick, those with disabilities, women with young children to look after, or young people who continued studying.” The results of Humanity Forward’s survey of Child Tax Credit recipients therefore reflects what we actually already know about unconditional cash programs.

We have to start thinking more about our future, and when our concern is work, we have to also consider the work our kids will do years from now. The CTC does not only assist parents right now. It also assists kids with the work they will eventually do as adults.

In a letter to Congress signed recently by over 460 economists in support of permanent Child Tax Credit expansion, they wrote:

“Expanding the CTC would yield a long-term fiscal payoff. Because reducing child poverty has a positive effect on earnings in adulthood, expanding the CTC would bring in more tax revenue down the road. By improving low-income families’ health, it would reduce government medical expenditures for this group. Once the full effects of the CTC expansion are accounted for, the net cost to taxpayers of the expansion has been estimated to be as little as approximately 16 cents for every $1 of new benefits.”

The CTC is a great deal. We have to start thinking more in terms of long term investments in a wider definition of work, the real costs of employment, and how counterproductive it actually is to tie benefits to employment and penalize low-paid and unpaid work by doing so.

The fully-refundable Child Tax Credit is a better way. It needs to stay.

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.