Evidence and More Evidence of the Effect on Inflation of Free Money

From Alaska to Kuwait and Beyond

Exhibit A of Wouldn’t Unconditional Basic Income Just Cause Massive Inflation?

It’s not like we don’t have any evidence of what happens when a lot of money is given universally to a lot of people. Consider the following real world examples.

Evidence from Alaska

Every year every qualifying resident of Alaska receives an annual dividend provided by the Alaska Permanent Fund. The most recent payout was $1,884 in 2014, for every man, woman, and child in Alaska. The first payout of $1,000 occurred in 1982.

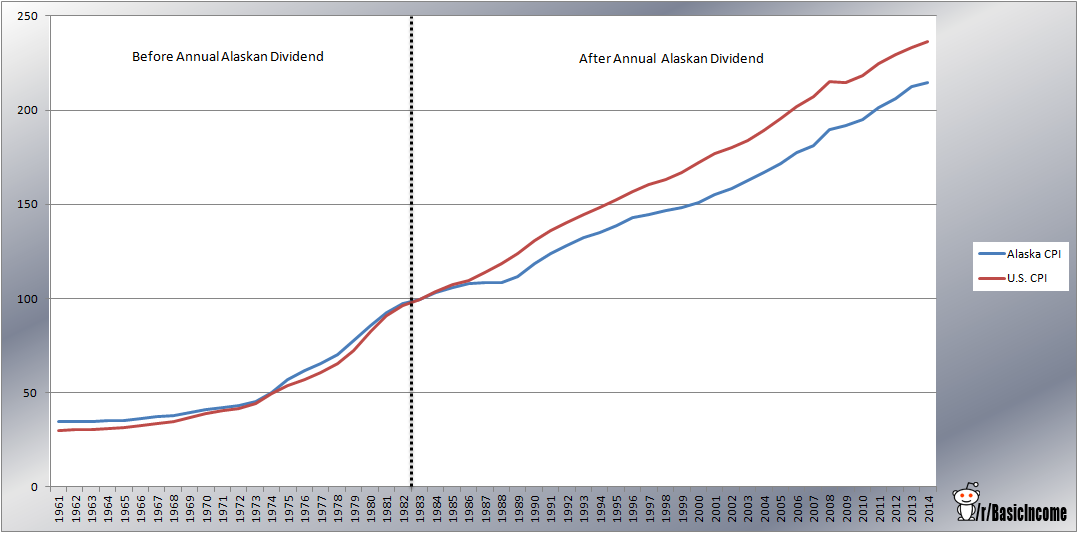

According to the New Zero Argument that any sizable universal cash transfer leads directly to its own nullification, this dividend paid to everyone should be entirely eroded by inflation. This hypothesis can be tested using the Consumer Price Index (CPI).

If inflation is a direct result of giving free money to everyone, we should see the CPI of Alaska begin to rise faster than the CPI of the rest of the country starting in 1982.

So what did happen?

Ever since 1982 Alaska has had LOWER inflation than the entire U.S.

CPI data reveals that prior to 1982, $1 did not go as far in Alaska than it did in the U.S. as a whole. 1982 was the last year this was true. Beginning in 1983, $1 in Alaska began to be worth more than in the U.S. as a whole, and this trend continues to this day.

Alaska CPI | US CPI 1981: 92.4 | 90.9 (last year without dividend) 1982: 97.4 | 96.5 (first dividend paid June 14) 1983: 99.2 | 99.6 (first full year with dividend)

The partial basic income provided in Alaska in the form of their Permanent Fund Dividend directly counters the fear of inflation with thirty years of a once larger CPI that began to grow at a slower rate than the rest of the country immediately following its introduction.

Alaska isn’t even the only evidence we have for the possibility that a basic income might even reduce inflation instead of increasing it.

Evidence from Kuwait

In 2011, the government in Kuwait decided to give every one of its 1.155 million citizens $4,000 USD each. That’s even higher than the Alaskan dividend and about one third of a potential US basic income. It was called the Amiri Grant.

Again, the New Zero Argument suggests inflation should increase, and this was a common fear in Kuwait as well. They were even especially worried because inflation was already a problem, so it seemed like the worst possible time for such a huge citizen demogrant.

So what did happen?

“With a great deal of public spending coming on-stream, and the effects of the substantial “Amiri” grant of KD1000 ($3605) awarded to every Kuwaiti, inflationary pressure is a concern. However, inflation dropped to an 11-month low of 4.6 percent in July, the last month for which figures were available, and the rate is expected to average 4.7 percent for full-year 2011, according to international press reports using figures from Kuwait’s Central Statistics Office.”

“Beyond the activity data, Kuwait’s macroeconomic outlook continues to look very solid. After peaking at 6 percent in December 2010, consumer price inflation had decelerated to 3.8 percent by February 2012.”

So in Kuwait, just as in Alaska, giving a large amount of free money to citizens did not only not result in increased inflation, but instead in decreased inflation.

Now what about the evidence for enhanced capitalism through basic income’s increased entrepreneurship effect? And what does this mean for inflation concerns?

Evidence of Increased Competition

In Uganda, the government gave about a year’s worth of income, or about $380, to a group of applicants, and denied it to the other half. There were no conditions on the money, but those who got it invested most of it in “skills and business assets,” ending up 65 percent more likely to practice a skilled trade. Recipients worked an average 17 hours more than those without the money. And compared to the group that didn’t get the cash, those who did saw a 49 percent increase in earnings two years later and a 41 percent increase four years out, indicating that the effects last.

A similar study in Kenya found that after poor families in rural Kenya were given an average of $513 by an NGO, their assets and holdings were 58 percent higher than a control group a year later, incomes were 33 percent higher, hunger was significantly reduced, and their psychological well-being increased.

Similar programs in South Africa, Mexico, and Liberia have all found similar results.

Increased entrepreneurship has also been found in Madhya-Pradesh, India where all adults in a number of villages received basic incomes and those with children received additional income. They invested in seeds and pesticides for growing their own food. They invested in livestock like goats, oxen, chicken, and cows. They bought capital like sewing machines for their own businesses making and selling clothing. There was a significant shift from paid labor to self-employed labor.

…far from encouraging laziness, the cash transfers have brought “more work, more productivity”, largely because they have inspired more “own account” farm and other working opportunities as an alternative to wage labor. Over one in five of the basic income villages increased their work activities, twice as many as in the control villages, and most of the villagers attributed the new farm or new business activity to the provision of the grants. Basic income villagers increased their livestock by 70 per cent Sarath says: “So basic income is not only a welfare story, it is a growth story too — inclusive and bottom-up growth that has stimulated the local economy.”

As repeatedly observed as a direct result of basic income, new businesses are created by those suddenly finding themselves with the capital to create them. In addition, these new endeavors, along with those small businesses already existing, find themselves with more customers with more cash to spend on their goods and services. Unless these businesses next create cartels in order to illegally fix prices, this inevitably leads to increased competition, as each business seeks to be the one to attract new customers and their new dollars.

This is important to understand as a business owner. As long as competition exists…

If you raise your prices to take the basic incomes of others, those who don’t will get their money instead, and your business could fail as a result.

(Return to Wouldn’t Unconditional Basic Income Just Cause Massive Inflation?)

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.